Knowland Insights: Coronavirus Pandemic – Hotel Group Impact and Actions

Large Losses of Business, Mitigation in the Short Term and Positioning for an Eventual Rebound

Knowland, the leader in revenue-generating hospitality meetings data and analytics, is tracking the impact of the Coronavirus pandemic on group business for the hotel industry. Today, Knowland announced estimated group cancellation rates across a 90 - 120 day booking window for the US/North America, Asia Pacific and Europe regions.

As expected, Asia Pacific has the highest cancellation rate with 90%, while U.S./North America hotels report a 40% cancellation rate for events and meetings. The U.S./North America rate has reached a relatively high level quickly as companies restrict travel and organizations cancel events in efforts to quickly control the spread of the virus and limit community exposure.

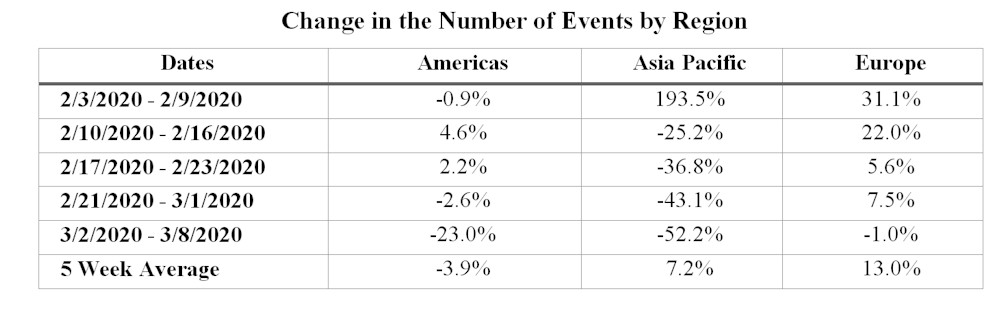

Knowland examined the number of events by global region in the weeks since the World Health Organization (WHO) declared COVID-19 an epidemic (January 30, 2020), then compared those statistics to the same day pattern from the prior year (Monday - Sunday).

In Table B, the percentage of change is represented for each week by region. In the first week after the announcement, each global region was either flat or well ahead of the prior year. However, with each progressing week, the performance weakens as the news and the virus spread. This occurs most dramatically in the Asia Pacific region, where the virus was first alerted, diagnosed and tested. The trends reflect the response lifecycle to the virus. As a result, we have seen greater impact in the Asia Pacific region, and we expect increases for North America and Europe in the coming weeks. However, because of the advance notice to regions outside of Asia, we can expect that the impact will not be as dramatic for these regions as they proactively act to control the spread and manage/isolate exposures.

Hotel Group Business Beyond 120+ Days

If there is a silver lining, it is that cancellations are holding relatively steady at approximately 20% from July 1st-onward. This likely reflects a "wait and see" attitude from buyers, which is prudent given the unknowns of the Coronavirus and how it may express itself over the next few months.

What Hotels Can Do in the Short Term to Reduce Group Business Impact of COVID-19

Data suggests that for the Asia Pacific region, the spread may be close to being over as reports show fewer new cases daily and the beginnings of recovery to occupancy due to local events. It is reasonable to expect that recovery will follow the same path of the virus: Asia Pacific to Europe to U.S./North America. For the U.S., the situation will likely get worse before it gets better. Hoteliers can brace themselves for group cancellations into Q2 and slowed new booking velocity for Q2/Q3. The best response for hotel owners and operators is to be calm and prepare for the reduction in group business using proactive sales strategies focused on transient and smaller local meetings.

Knowland recommends the following approaches to help capture the group business that remains active:

· Target smaller events with local companies, including sales meetings, strategy sessions and other events with focused, limited attendees.

· Consider larger events that will likely be replaced with smaller, regional meetings. Companies will choose to have meetings within drive markets that allow them to limit exposure for their employees but still offer face to face meetings that foster collaboration and team engagement.

· Offer to add a Live Stream to a local event; hotels can partner with A/V providers to create virtual meeting environments that are interactive and safe by bringing in remote attendees using video technology.

· Provide technology that enables speakers to present remotely; if you can help a business facilitate a remote speaker with Skype or Zoom, they can still achieve strategic objectives without travel or large meetings.

· Complement all meetings with a proactive delivery of hand sanitizing stations, upgraded maintenance and housekeeping, and other tangible actions to create confidence with your clients.

"The rapid spread of this virus and the speed at which it is re-ordering the Travel and Hospitality world is unprecedented, but as travel professionals, we are NOT powerless," said Robert Post, Chairman & CEO of Knowland. "At the center of any and all actions is the safety of our traveling public, and hotels that act in this manner will capture a share of the business that exists in the short term and be positioned for the eventual rebound." At a later date, Knowland will address strategies for the rebound and how it will take shape based on its latest data analysis.

At this time, there are no federal restrictions in place to prevent meetings and travel within the United States, but the Centers for Disease Control and Prevention (CDC) is recommending no meetings/gatherings over 10 people. Knowland believes hotels will earn more credibility with the public by following the latest directives from the CDC and local public health authorities.

About Knowland

VP, Marketing

Knowland

T: 301-704-4087

E: kandrews@knowland.com

W: http://www.knowland.com

Follow us on Twitter: https://twitter.com/knowlandgroup?lang=en

Become a Facebook Fan: https://www.facebook.com/theknowlandgroup/